FE Report

The government Thursday proposed to slap capital gains tax on companies, sponsors and directors doing stock trading in the country's two bourses.

Finance Minister AMA Muhith spared millions of individual investors from the tax hook, but he slapped a whopping ten per cent tax at concessionary rate on companies trading shares in the country's two bourses.

He also imposed five per cent tax on income of sponsor shareholders or directors of companies engaged in trading in the Dhaka and Chittagong stock exchanges and three per cent tax on the shares of companies sold at a premium value.

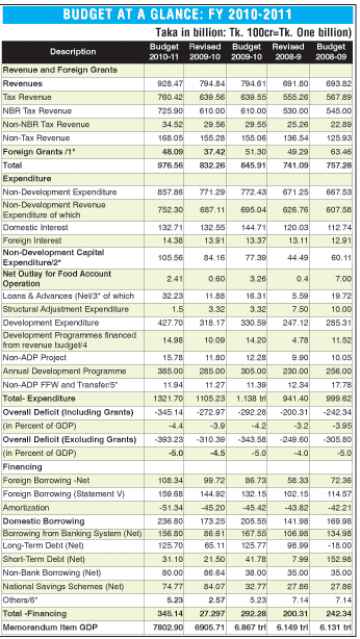

"We are firmly committed to maintain a steady growth in and development of the capital market," the minister asserted as he unveiled the budget for the 2010-11 financial year.

But he said: "Continuing with the existing provision of keeping income of individual investors free from tax, I have made some proposals for imposition of tax at a lower rate in other cases".

"16E. Charge of tax on sale of share at a premium over face value.

Notwithstanding anything contained in any other provisions of Ordinance of 1984 or any other law, where a company raises its share capital through book building or public offering or rights offering or private placement or preferential share or in any other way, at a value in excess of face value, the company shall be charged, in addition to tax payable under this ordinance, premium tax at the rate of three per cent on difference between the value at which the share is sold and its face value.

"53L. Collection of tax from sale of share at a premium over face value.- Where a company raises its share capital through book building or public offering or rights offering or private placement or preferential share of in any other way at a value in excess of face value, the Securities and Exchange Commission shall collect premium tax at the rate of three per cent on different between the value sat which the share is sold its face value from the concerned company at the time determined by the SEC."

"53M. Collection of tax from transfer of share by sponsor shareholders of a company listed with stock exchange. The SEC at the time of transfer or according consent to transfer, by any means, the shares of a sponsor shareholder or director of a company listed with a stock exchange shall collect tax at the rate of five per cent on difference between transfer value and face value of the shares."

Muhith pledged more reforms in securities market to make it attuned to global standards and protect shareholders interest, but he assured some 2.5 million individual traders that they would be kept out of tax net.

"I would like to make it clear that income earned by individuals through trading of shares of any listed company shall remain out of the purview of taxation," he said.

Muhith told the parliament that share market boomed after the Awami League government came to power nearly one and a half years back